What is a state pension? How much is full state pension per week? When does a spouse get a state pension? The full new State Pension is £175.

The actual amount you get depends on your National Insurance record. The only reasons the amount can be higher are if: you have over a certain.

How to get and claim your State Pension, State Pension age. If your State Pension is under £per week, you’ll be paid. You may have to pay tax on your State Pension.

Image: Getty) In order to check your National Insurance recor you will need a Government Gateway ID. The State Pension is not affected by the amount saved. But the interest earned from the savings may exceed the limit allowed for claiming supplementary benefits.

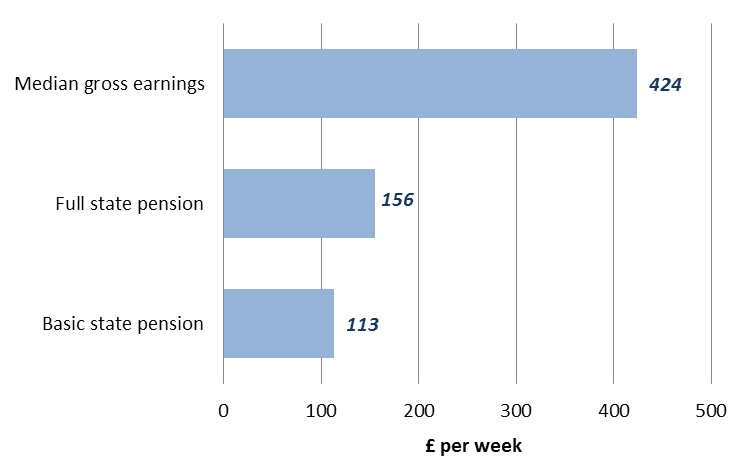

The maximum basic pension (based on National Insurance ontributions) is £87. Most people will also have their pensions topped up with Additional pension (SERPS or state 2nd pension). The minimum amount the government says.

If you receive the new state pension of £164. Each tax year (April to April) that you pay or are credited with National Insurance contributions counts as a qualifying.

New state pension payments, meanwhile, are based on your own NI record – rather than that of your husban wife or civil partner – although you can still inherit extra under certain conditions. However, you can continue to build up your State Pension to the maximum (currently £17per week) up until you reach State Pension age.

There are two different systems for claiming State Pension. You can do this even if you already have years of National Insurance contributions or credits – see the later section on topping up your State Pension. Contribution record.

The additional state pension only increases by the rate of CPI inflation (announced in September) rather than being linked to the triple lock guarantee. This means that the additional state pension will only be increased by 2. State Pension provides a welcome financial boost for those who have lived and worked in Britain throughout their lives.

Currently, women and men are entitled to the same amount under current State. Those who receive the State Pension achieved a healthy income boost this month. It will take around three-and-a-half years of receiving your state pension to recoup your outlay, and you’d get the extra pension for the rest of your life.

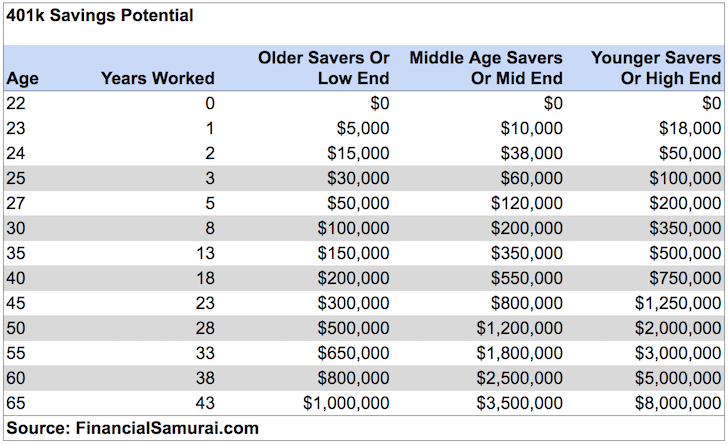

For defined contribution pension schemes, including all personal pensions, the value of your benefits will be the value of your pension pot used to fund your retirement income and any lump sum. For defined benefit pension schemes, you calculate the total value by multiplying your expected annual pension by 20.

In addition, you need to add to. The number of years required to reach the maximum State Pension has also changed over the years. Your State Pension is based on your National Insurance record.

This equates to a total rise of £262. However, if you worked for someone else rather than yourself in the past, you might have built up entitlement to additional State Pension under the old system and get more than this. The new full state pension is worth £175.

The age at which you can start to claim your state pension from. A handy list of the basic state pension amounts for single persons and married couples by year. Sometimes the state pension can end up being the.

Those who are entitled to the Basic State Pension will see an extra £5. Retirees on the new State Pension can look forward to an extra £6. After all, the new State Pension pays out just £175. G is here – and shares of this ‘sleeping giant’ could be a great way for you to potentially profit!

The current flat rate state pension is £110. Stuart Feast, the director of pension and retirement. Differences between SERPS and S2P.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.