When you apply for a mortgage, lenders calculate how much they’ll lend based on both your income and your outgoings – so the more you’re committed to spend each month, the less you can borrow. We’ll work it out by looking at your income and your outgoings. It should take about five minutes to.

Once all the information has been entere click on the " Calculate ! Adjust the sliders to change the term to the number of years you have left to pay, and increase the interest rate. The exact amount will depend on the type of mortgage and the lender.

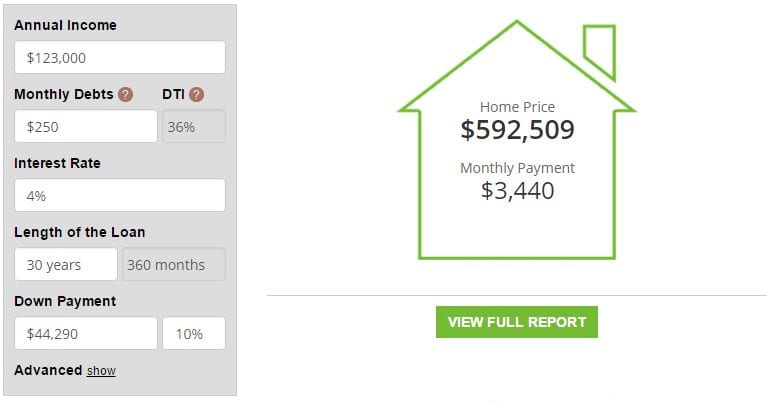

The calculation shows how much lenders could let you borrow based on your income. The amount shown is an estimate based on a multiple of your sole or joint income. You need to go directly to a lender to find the exact amount they can lend you.

With a single overpayment of £50you will pay off your mortgage. Assuming your monthly repayment amount remains the same. There may be early repayment charges if you pay your mortgage early.

Check with your lender before making overpayments. What is a mortgage calculator? However, you may still complete an Agreement in Principle (AIP) to see how much you could borrow.

How much can I borrow? Typically, lenders will determine how much you can borrow by multiplying your salary by four and a half or five times.

On an interest rate of 3. Try out the take-home calculator and see how it affects your take-home pay. If you have several debts in lots of different places (credit cards, car loans, overdrafts etc), you might be able to save money by consolidating them into one loan.

Try Our Free Online Calculator Now! Award-Winning Equity Release Specialists. It’s free to use and there are no credit checks involved. If you wanted to set a goal to pay off a loan in years but originally took out a 25-year mortgage then adjust the above calculator to years.

A £180loan structured over years will see the borrower pay £5581. If the same loan was paid off in 15-years the monthly payment would jump from £788. Do bear in mind you should plan to pay your mortgage off before you reach your retirement age.

Get a rough idea of how much you could borrow for a residential mortgage based on your personal circumstances. Earnings needed for 350k mortgage.

Example income requirements for 120k, 160k, 400k, 500k, 600k, 800k and million. Debt To Income Ratio. Affordability Rule Of Thumb. Mortgages based on 4-4.

The actual amount you could borrow will depend on a number of factors, including the amount of deposit you have, any outstanding credit commitments and your monthly outgoing. We use cookies to make the site easier to use.

Read our cookies policy. A quick and easy way to calculate your monthly mortgage payments. Simply enter the amount you wish to borrow, the term over which you intend to pay it off and the interest rate.

A low debt-to- income ratio is ideal. It demonstrates a positive balance between your debt and income and suggests you will be able to pay off your loan without too much trouble.

On the other han a high debt-to- income ratio means that you may have too much debt and would struggle to pay off any additional expenses. This is what lenders care about.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.