Payments are taken on the first working. Can I pay my vehicle tax by direct debit? What is car tax direct debit? Can direct debit be cancelled? You’ll need to meet. Use the eleven (11) digit number on the V5C (vehicle log book). Thus, choose how often you want to pay (monthly, biannual, or once per year). If you have direct debits with the DVLA, these will be automatically stopped and your car tax will no longer be valid. Vehicle tax rate for vehicle Month rate £71.

Monthly by direct debit totalling £136. The direct debit will automatically renew your car tax each year but will automatically cancel if you SORN, sell your vehicle, scrap your car or export your vehicle out of the UK.

Obviously though, this requires that the correct procedures are followed under each circumstance. Tax including direct debit enquiries, declaring a vehicle off the road (SORN) or refunds of tax : Buying or selling a vehicle: Changing vehicle or personal details, replacing any documents including.

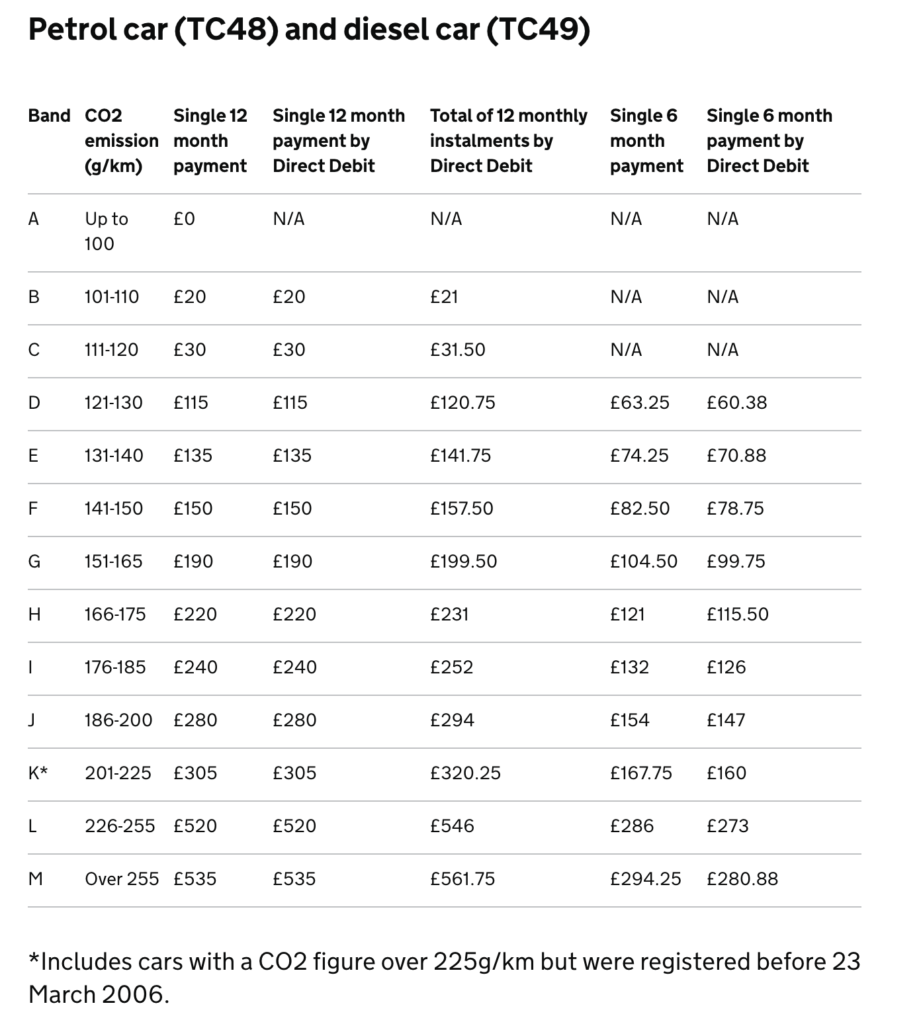

If you choose direct debit, payments will continue automatically for as long as you hold a valid MOT, or until you cancel the direct debit or inform the DVLA that you no longer have the car. However, be aware there is a 5% charge for paying monthly or six-monthly.

For example, the total payable for months road tax by monthly instalments is £246. Even though the new rules started on 1st October, the direct debit option was only even going to be available for people needing to tax their car for a tax due to start on 1st November.

Do I still need a tax disc for my car? If you fail to pay the DVLA before driving away, you could be fined £8 or a maximum £0if the fine is not settled within days.

And of course, you won’t be insured if you’re not taxed. No road tax = no insurance.

The most any car driver will currently pay in extra fees is £2 and that is for a vehicle which is rated in Band M, which means the vehicle emits over 255kg of COper kilometre. V5C reference number along with your car’s registration number. How to pay for car tax. Visit DVLA Tax your vehicle online.

If your vehicle is off the roa you will need to register a Statutory Off Road Notification (SORN) with the DVLA to avoid paying vehicle tax. If you have already paid some tax, you’ll automatically be eligible for a refund- this will arrive by cheque and is calculated from the date that the DVLA receives the information.

Obvs I cannot get one. This applies even if there is no fee to pay (e.g. if a disabled driver has a vehicle exempt from road tax ). In addition, motorists will be able to pay vehicle tax by direct debit annually, biannually or monthly. The amount you pay in UK road tax depends on the size, type and emissions of your vehicle.

Some readers were concerned they wouldn’t know if a car was taxed. Use the digit number on your vehicle log book (V5C) to apply for the tax as you you will not have the reminder letter. My Profile My Preferences My Mates.

Hi guys, just a quick one, picking up my new car tomorrow and I'm just about to tax it now, however when I try. Pay no tax on your car for life. Only cars in “band A” were exempt from VE and these tend to be smaller vehicles such as Ford Fiestas. I sold a van back in June and I just noticed today I am still being charged tax monthly on the vehicle via direct debit by the DVLA.

I left the country for an extended period a couple of days after the sale. When looking into the new tax system i read on the DVLA site that when paying by direct debit, as soon as they are notified of a change of keeper the direct debit will be stopped and no further.

Direct debit set up car tax.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.